QUICK & EASY SOLE TRADER ABN

Only $49 per ABN Registration

We want to see you in business as quick as possible so we're offering all Sole Traders the speediest ABN registration service.

What are you waiting for?

Very affordable ABN setup! We're saving you time AND money- win!

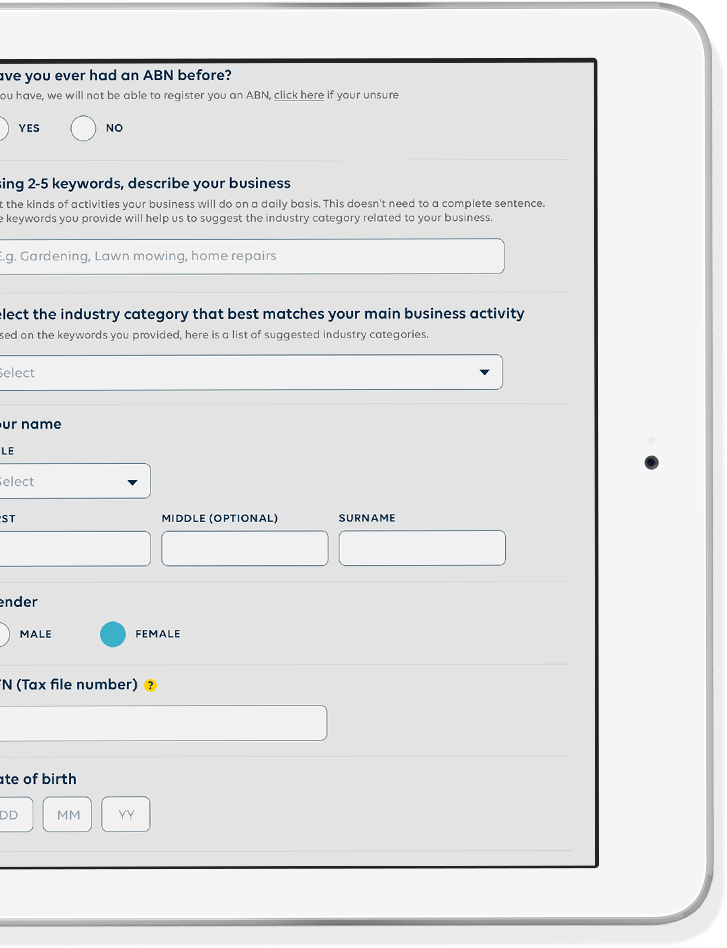

One simple form, takes on average 1 minute to fill out.

How it works

It's as easy as 1, 2, 3

Complete one simple form.

All you need is your TFN and a few basic details to kick start the process.

Lodge via our online registration tool.

We lodge your application online and provide you with a new ABN.

Bingo, you’re ready to trade.

If the ABR gives you the tick of approval you’ll receive an email confirmation from us with your ABN number.

Need more than an ABN registration?

Veromo offers much more than just ABN’s, we offer a range of business packages for all businesses, great and small.

Sole Trader Package

Simple cost effective, light on admin. What’s not to love? Sole trader is the structure of choice for those who want the freedom to trade on their own - and call all the shots.

Partnership Package

Thinking two heads are better than one? A partnership opens-up multiple resource streams and shared responsibility, without the red tape of a company structure.

Company Package

Being an entity of its own, a company lets you mix up management, with some good tax breaks to be had. Plus, when world-domination occurs it's easy to sell or pass on.

Frequently Asked Questions.

What is an ABN?

An ABN (Australian Business Number) is a unique number issued by the ATO to all eligible entities. The ABN system works together with the GST and PAYG withholding system.

How long does it take to get an ABN?

In the majority of cases your ABN will be issued immediately. However if there is an issue with your application there could be a delay of up to 28 days.

Why do I need an ABN?

Your ABN enables businesses within Australia to deal with a range of government departments and agencies using a single identification number. The ABN is a public number which does not replace your tax file number.

You will need to put your ABN on your invoices and this will avoid a withholding 46.5% of the payment your customers make to you. An ABN also enables you to register a domain name and business name.

Do you register me for GST?

If you are expecting to earn over $75k then you must register for GST. Otherwise GST registration is voluntary. If you know you will earn more than $75k then you must let the ATO know.

What information do I need to register for an ABN?

You will need to provide us with your TFN, birth details, email address, your residential address and your business address.

What issues could cause a delay with my ABN?

If you have previously held an ABN and it was cancelled this can cause a delay. There are cases when the information you provided in your application does not match the information held by the ATO and your application will be processed manually and can take up to 28 days.

If I have had an ABN before but it was cancelled can I use it?

You will need to contact the ABR to get it reactivated.

I think I've had an ABN in the past, how can I tell if it’s still active or not?

The ABR’s Name Lookup tool allows you to easily and efficiently do multiple searches using names recorded against an ABN. You can check for your ABN here.